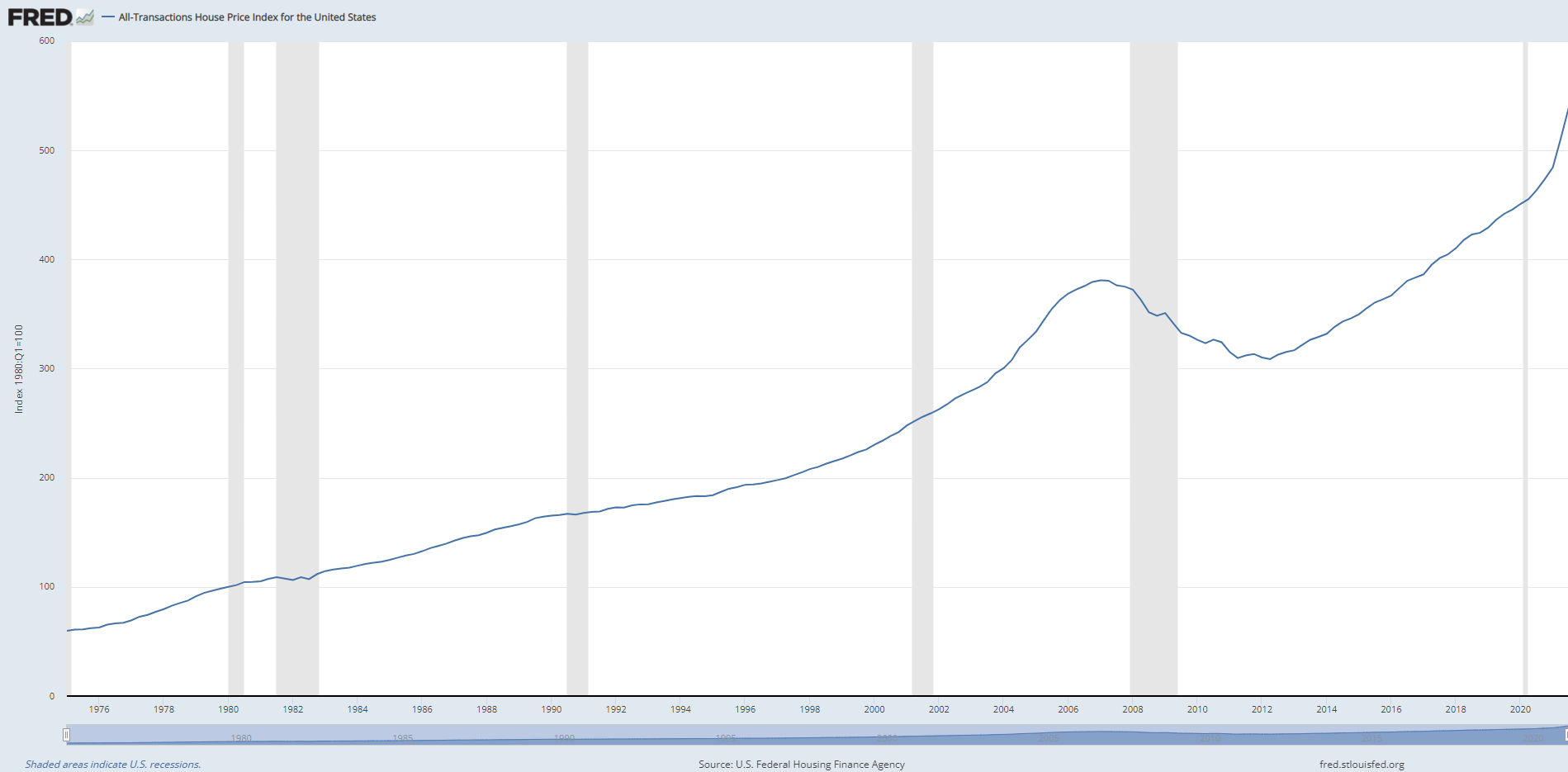

I haven’t invested in the stock market because of its volatility and because no one I know seems to know what they are doing or have made lots of money doing it. Maybe I’m around the wrong people. I invest in real estate for the reasons listed here. If we look at a graph of house prices in the US, their values have always gone up despite occasional dips. That’s the kind of graph you want to see.

Though you can make a lot of money investing in real estate, you can make even more if you invest early in certain stocks. The problem is in knowing which stocks to invest in.

DISCLAIMER: I am not a professional stock market investor. At the time of this writing, the only stocks I own are the ones given to me by my employer. This article is just my personal opinion at the time of this writing.

Investing in Index Funds

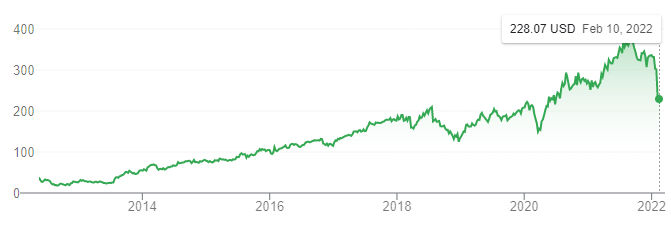

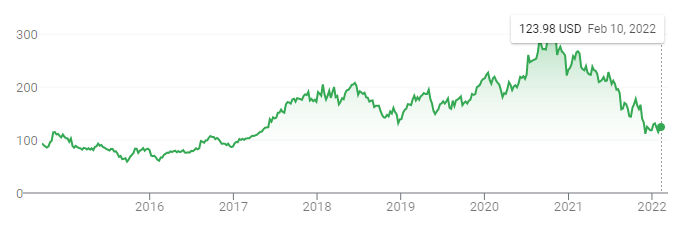

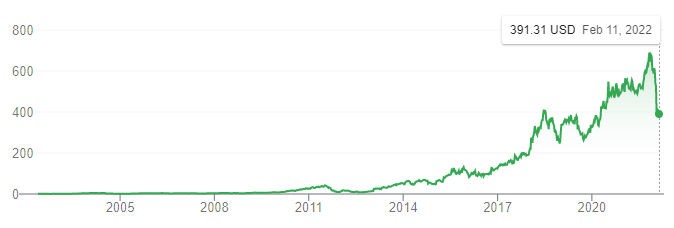

Warren Buffett, known as the “Oracle of Omaha,” is an American businessman and philanthropist, widely considered the most successful investor of the 20th century. He has amassed a personal fortune of more than $60 billion by defying prevailing investment trends. Instead of stock picking, Buffett suggested investing in a low-cost index fund. “I recommend the S&P 500 index fund,” Buffett said, which holds 500 of the largest companies in the U.S., “and have for a long, long time to people.” … “I just think that the best thing to do is buy 90% in S&P 500 index fund.” He specifically identifies Vanguard’s S&P 500 index fund. Vanguard offers both a mutual fund (VFIAX) and ETF (VOO) version of this fund. He recommends the other 10% of the portfolio go to a low-cost index fund that invests in U.S. short-term government bonds. Below are stock charts for VFIAX and VOO.

As you can see, both have an overall consistent upward trend. If you invested in each one 10 years ago, in 2012, you could have quadrupled your investment. Twelve years ago, one share of each was about $100. And now, each is around $400. But, if you only bought 1 share, then you would have only made $300 in 12 years. What if you invest $10,000 at the time. Then, you would have made $30,000 in 12 years. Or, instead of putting 20% down on a $400K house, you put $100K in one of these funds. Then in 12 years, you would have made $300K. Though that’s not bad, you would make more in real estate, especially if you include rental income, but then again, owning rental properties is not 100% passive. Nevertheless, if you don’t want to or can’t invest in real estate, then investing in one of these funds over the long term appears to be a safe bet.

Stock Picking

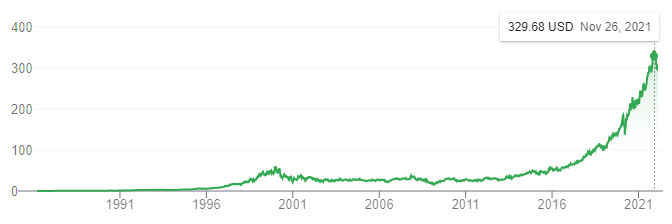

If you want to pick stocks, you obviously want to pick ones that have the potential to grow fast. Tech companies seem to get more publicity for many reasons such as everyone’s familiarity with them and their potential to change the way we live. For example, there was a ton of publicity before and during Facebook’s IPO. Everyone knew what Facebook was at the time. Facebook went public on May 18, 2012, and shares closed the first day of trading at $38.23. Now, the value is $228. That’s a 6x increase in 10 years. When you invest in stocks, the general advice is you shouldn’t invest more than you can feel comfortable losing. At the time, I probably wouldn’t have minded losing $1000. Had I invested $1K in FB, the investment would be worth about $6K now (10 years later) for a $5K profit. That’s still a very petty profit. If I had $50K, which is about the cost of a down payment on a $250K house at the time, then the investment would be worth $300K now for a $250K profit. While that is a good profit, there’s no way I would have invested $50K in FB at the time because I would not have felt comfortable losing it all. With real estate investing, however, it’s so much safer and predictable that one need not worry about their losing their investment. Plus, had I invested $50K in real estate instead of FB, I would still have made a profit of $250K or more in the same period.

Following are stock price graphs of some of the biggest and most popular tech companies along with how much you could have made if 10 years ago you had invested $1000 in each.

FACEBOOK (FB)

- IPO date: May 18, 2012

- Opening price: $38

- Price in 2012: ~38

- Price in 2022: ~ $300

- Price increase factor: 7.9x

- Profit from $1K investment: $6900

Microsoft (MSFT)

- IPO date: March 13, 1986

- Opening price: $21

- Price in 2012: ~50

- Price in 2022: ~ $320

- Price increase factor: 6.4x

- Profit from $1K investment: $6400

Apple (AAPL)

- IPO date: December 12, 1980

- Opening price: $22

- Price in 2012: ~25

- Price in 2022: ~ $155

- Price increase factor: 6.2x

- Profit from $1K investment: $6200

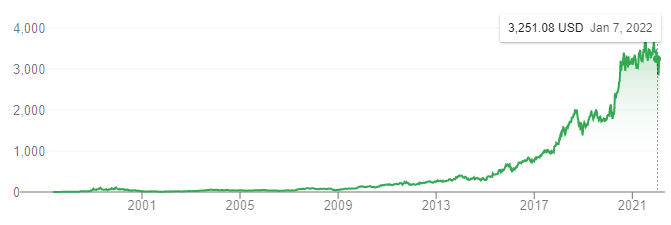

Amazon (AMZN)

- IPO date: May 15, 1997

- Opening price: $18

- Price in 2012: ~200

- Price in 2022: ~ $3200

- Price increase factor: 16x

- Profit from $1K investment: $15000

Alphabet (GOOG)

- IPO date: May 15, 1997

- Opening price: $18

- Price in 2012: ~200

- Price in 2022: ~ $3200

- Price increase factor: 16x

- Profit from $1K investment: $15000

Alibaba (BABA)

- IPO date: Sept. 14, 2014

- Opening price: $68

- Price in 2022: ~ $125

- Price increase factor: 1.8x

- Profit from $1K investment: $800

Netflix (NFLX)

- IPO date: May 23, 2002

- Opening price: $15

- Price in 2012: ~15

- Price in 2022: ~ $400

- Price increase factor: 26x

- Profit from $1K investment: $25000

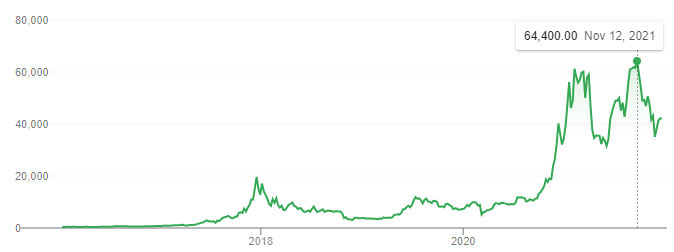

Disruptive Technologies

Disruptive technologies also have a large potential for a huge gain. Everyone has heard of Tesla, the automaker that has proven that electric vehicles can replace gas vehicles. Then there’s Bitcoin which revolutionizes money.

Tesla (TSLA)

- IPO date: June 29, 2010

- Opening price: $3.84

- Price in 2012: ~6

- Price in 2022: ~ $1000

- Price increase factor: 166x

- Profit from $1K investment: $165000

Bitcoin (BTC)

- Price in 2012: ~$320

- Price in 2022: ~ $43000

- Price increase factor: 134x

- Profit from $1K investment: $132000

Conclusion

Based on the analysis above, if you are going to hold on to popular tech stocks for the long term, e.g. 10 years, then you’re probably safe in that you won’t lose money and will likely profit. Of course, how much you profit will depend a lot on how much you invest and luck. One pattern to note is the performance of disruptive tech (electric cars, cryptocurrency) which realized the biggest gains. Considering the above, I think a safe and good investment diversification strategy, if you are comfortable managing rental properties, is

- 75% real estate

- 5% S&P 500 index fund – mutual fund (VFIAX) and/or ETF (VOO)

- 15% disruptive tech

- 5% big tech