According to RocketMortgage, the average mortgage term is 30 years and the average length is under 10 years. This is because homeowners will either refinance their home, like I did to get a much lower interest rate, or because they want to move. Refinancing your mortgage to get a lower interest rate makes sense if the new rate will be much lower such that you’ll end up saving money. You’ll just have to keep in mind that if you’ve had your mortgage for 10 years, for example, and you refinance, the clock resets and you’ll have 30 years to pay off your mortgage instead of 20. For this reason, I personally continue to pay the same monthly payments at the higher interest rate so that I pay less interest and the mortgage is paid off sooner.

But what if you sell your home to buy a new one within 10 years? What many people may not realize is that by doing this, they will lose a lot of money because their home loan is an amortized loan rather than a simple interest loan. Amortized loans favor lenders, like banks, instead of borrowers. Unlike a simple interest loan, where you’re paying the same amount towards principal and interest each month, when you get a mortgage, most of your monthly payments go towards interest in the beginning and less near the end of the 30-year term.

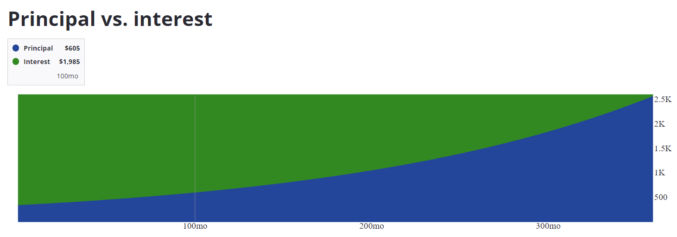

Consider an amortization schedule for this loan:

| Loan Amount | $400,000 |

| Interest rate | 6.731% |

| Loan Term | 30 years |

| Total principal payments | $400,000 |

| Total interest payments | $532,165 |

Note that your total interest payments over 30 years is more than the loan amount.

Let’s take a few points in time and compare how much of your monthly payment goes towards principal and interest.

| Principal | Interest | Percent Towards Interest | |

|---|---|---|---|

| First mortgage payment | $346 | $2244 | 86.64% |

| Mortgage payment at month 100 (8.3 years) | $605 | $1985 | 76.64% |

| Mortgage payment at month 200 (16.7 years) | $1058 | $1531 | 59.13% |

| Mortgage payment at month 236 (19.7 years) | $1294 | $1295 | 50% |

| Mortgage payment at month 300 (25 years) | $1851 | $738 | 28.51% |

| Mortgage payment at month 360 (30 years) | $2578 | $14 | 0.54% |

As you can see, in the first 10 years of your mortgage, the bulk of your monthly payments goes towards paying interest. Your equity from paying down the principal is very little. Therefore, if you sell your house within the first 10 years and buy a new one, you’ll have little equity from your mortgage payments and, when you get a new mortgage for your new home, you’ll start over from month 1, when most of your new monthly payments will go towards interest again.

Of course, your house could appreciate significantly in 10 years, in which case the equity you gain from appreciation could outweigh the equity from paying off the principal. However, that is not always the case.

If you’re planning on selling your home within 10 years and buying a new one, it may not be worth it since you may lose a lot of money from having mostly just paid interest.