Buying a house can be stressful, especially in a hot market. If you wait too long to put in an offer, it may be too late as the seller may have already accepted a existing offer in which case the buyer would be “in contract” (pending sale) in which case the seller can’t accept other offers while in contract. Therefore, getting “in contract” quickly blocks other buyers.

Property Appraisal

Of course, the more you offer to buy a house, the more interested the seller would be to accept your bid. However, you don’t want to offer too much as you could be overpaying. Let’s say you find a duplex on sale for $360,000. You then do some research to determine if $360K is the market value.

Redfin Estimate

According to Redfin, you find that the house is estimated at $360K. However, Redfin shows you how they came up with that estimate using comparable properties in the area. After looking at the comparables, you find that Redfin’s automated estimation algorithm is using single family homes as comparables instead of duplexes. Obviously, single family homes are not good comparables if the subject property is a duplex.

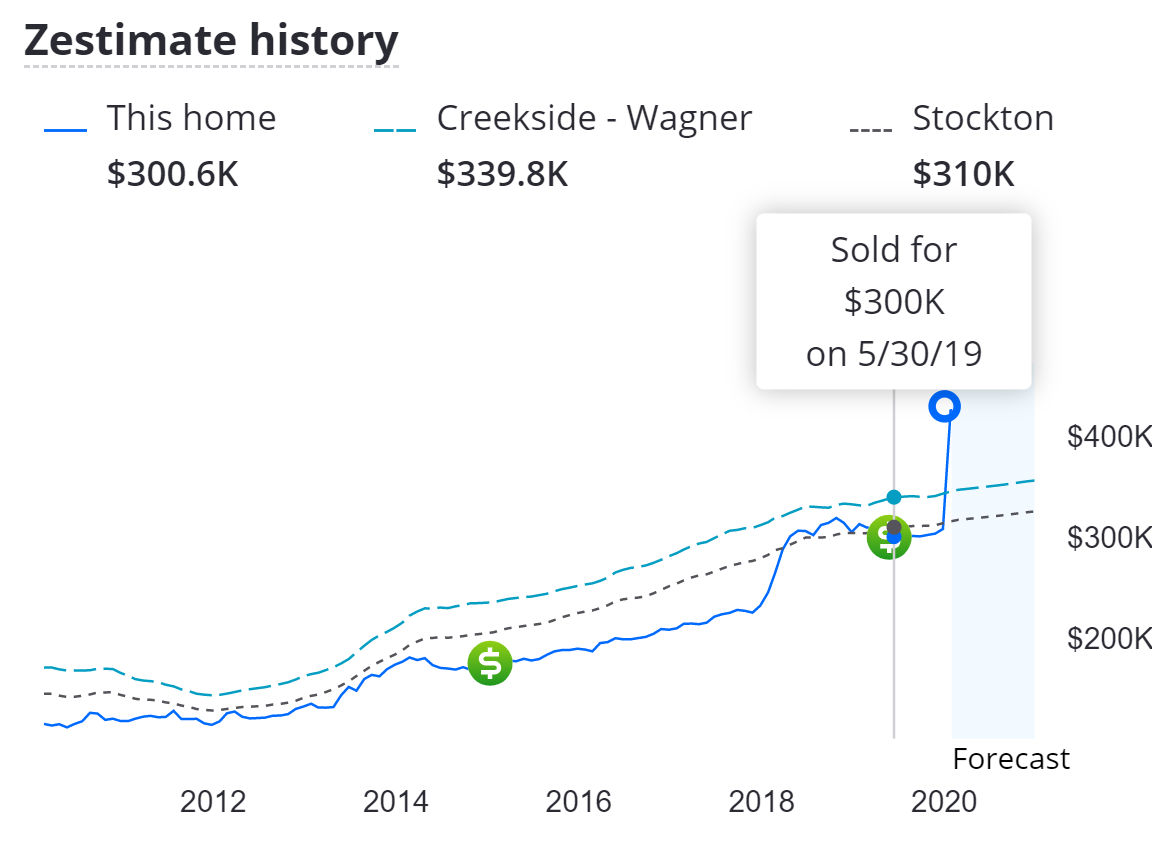

Zillow Estimate (Zestimate)

According to Zillow, you find that the house is estimated at $346K. Like Redfin, Zillow shows you comparables that they used to come up with their Zestimate. After looking at the comparables, all but two of them are single family homes. In general, when comparing the price per sq ft of a single family home to a duplex, the latter is almost always cheaper. Therefore, Zillow’s automated estimation algorithm isn’t taking into account this difference which results in a relatively high estimate.

Hand-Picked Comparables

Your real estate agent can provide you a listing of comps (comparables) for your target house. In doing so, the agent can pick better comparables, e.g. duplexes only, to compare against. According to one of 10 different comps, you can create a spreadsheet to determine the average price per square foot as shown below.

According to this analysis, the average price per sq ft for similar duplexes recently sold in the area is $136 per sq ft. Since the target property area is 2240 square feet, then a more accurate estimate of its value is 2240 x $136 = $304K. Since this estimate was manually done taking into account similar types of homes (duplexes) which is how a certified appraiser would estimate a property’s worth, then this estimate is likely to be more accurate.

If we list these 3 estimates side by side, we get

- Redfin: $360K

- Zillow: $346K

- Manual: $304K

There’s a huge difference in estimates. Since the seller is asking for $360K, then if you put in an offer for $304K, the seller will likely reject your offer, even though you know the house should be worth $304K +/- 5%. It may be possible that the seller recently renovated the property to justify a high asking price however, in this particular real example, that is not the case as the seller only painted the exterior of the house and replaced a patch of weeds with black mulch.

UPDATE: Two months after passing on this property which the seller was asking $360K for, the seller accepted an offer for $300K, which is more in line with my estimate than Zillow’s estimate. Don’t trust Zillow or Redfin’s estimates. Do your own appraisal.

Strategy #1: Use The Same Agent as the Seller’s Agent

From my experience attempting to buy houses in a hot market where there are multiple offers, what often happens is I’d put in an offer above asking price only to be outbid by another slightly higher offer. This is very frustrating because I was never given the opportunity to offer more. Since California allows dual agency where a real estate agent can represent both buyer and seller, it would make sense to hire the seller’s agent to be your agent as well. The seller’s agent would obviously know how much the other offers are and can therefore provide you with this information so that you can place a competitive offer that is unnecessarily high. Your agent has a fiduciary duty to help you buy the property for the lowest price you can get it, even if that lowers their commission. After you submit an offer that is higher than other offers, if a new offer comes in that is higher, your agent – who is also the seller’s agent – could inform you of this so that you can submit a new, higher offer that is just high enough to be more attractive to the seller. This arrangement is a win-win-win for all parties involved.

- Seller – the seller can get a higher sale price

- Buyer – the buyer can outbid other offers and therefore get the property

- Agent – get double the commission

So, when you find a house you like on Zillow, it’ll show the contact info for the seller’s agent. Just contact that person to be your agent as well.

Get Cash Back

You can also try to negotiate with the seller’s agent to get cash back. Offer the seller’s agent to be your agent if they are willing to split the commission 50/50 with you. Each agent in California gets 3%. So, on a $500K house, each agent gets $15K. You can tell the seller’s agent this:

I have an agent I normally use but you can be my agent if you are willing to split the commission with me 50/50.

In this case, the agent will get 4.5% instead of 3% ($22,500) and you will get 1.5% ($7500). Win-win for both parties.

Strategy #2: Offer More But With Contingencies

Another strategy would be to put a bid in for a certain amount that you think the seller will accept BUT add an appraisal and financing contingency to protect yourself from overpaying. Let’s say you put in a bid for $346K, the Zillow estimate which most people including the seller’s agent are familiar with. As that is the Zestimate, it’s reasonable that the seller would consider it a fair bid. Once the seller accepts your bid – which contains the appraisal contingency, of course – then you will be in contract to block out other buyers. Then, once you get a real hand-made appraisal done by a certified appraiser, it should conclude that the value of the target property is $304K +/- 5% which gives it an upper value of $319K. Since this value is less than your bid price of $345K, then you have the option of walking away without losing your deposit or you can show the appraisal report to the seller and argue that the house isn’t worth $346K and that you would be willing to write an addendum to the contract stating that the revised price is $319K, for example. If the seller accepts your revised price based on the appraisal, you can proceed, otherwise, you may want to walk away to avoid overpaying, unless you really want the house. Either way, at this point, you’d be in contract so you’d have exclusive access to negotiate with the seller to come up with a price you are willing to pay.

Strategy #3: Submit Offer With a Pre-Approval Letter, Not a Prequalification Letter

When you submit an offer and you plan on getting a loan, the seller may worry about you not being able to successfully close on the loan. You can submit the offer with a pre-qualification letter or a pre-approval letter.

Pre-qualification letter

A pre-qualification letter can give you an estimate of how much money you can borrow. Since the information is not verified, you can get it instantly. According to Bank of America, the information you need to provide is

- Income information

- Social security number to run a credit check

- Basic information about bank accounts

- Down payment amount and desired mortgage amount

- No tax information required

Pre-approval letter

A pre-approval letter is similar to a pre-qualification letter except your financial information is verified.

Pros:

- You are more likely to get the loan

- Sellers are more likely to believe you will get the loan and therefore may choose you over other offers that only include a pre-qualification letter

Cons:

- Usually not instant. At Bank of America, it can take up to 10 business days.

- More documentation is needed

According to Bank of America, the information you need to provide is

- Copies of pay stubs that show your most recent 30 days of income

- Credit check

- Bank account numbers or two most recent bank statements

- Down payment amount and desired mortgage amount

- W-2 statements and signed, personal and business tax returns from the past two years

If you can submit your offer with a pre-approval letter, that would be advantageous as it would make your offer appear stronger. However, not everyone understands the difference between a pre-qualification and a pre-approval letter. Therefore, you may want to highlight this difference in your offer to ensure the seller understands why your offer is better than others that only have a pre-qualification letter.

Strategy #4: Get Maximum Pre-Approval

Let’s say that you follow strategy #1 and your agent is the same as the seller’s agent. You then put in an offer you and your agent think is high enough. But, to you and your agent’s disappointment, you find that another offer came in at the last minute that is higher. If your pre-approval letter is for a lesser amount, it could take too long to request a pre-approval letter for a higher amount. So, from the beginning, get a pre-approval letter for the most you can afford so that you can update your offer quickly depending on other bid amounts.

Strategy #5: Escalation Clause

Since you don’t want to offer more than you need to but still win, one strategy is to add an escalation clause in your offer that automatically increases your offer by X dollars above the highest bid up to a maximum of Y dollars. The California Association of Realtors (CAR) offers this quick guide on escalation clauses.

Here’s example wording where the seller’s asking price is $360K and the Zestimate is $360K.

- Buyer’s offer is for $365K.

- If there are competing offers that are higher, Buyer’s offer shall be $1000 higher than the highest offer up to a maximum of $400K. In the event of an automatic escalation,

- Seller shall, upon acceptance, provide buyer with a copy of the highest offer received.

- Buyer has a right to contact that prospective purchaser making that offer, or his or her agent, to verify the validity of that offer and that the other offer is in fact a bona fide offer.

- Buyer is PRE-APPROVED for up to $400K.

Strategy #6: Represent Yourself

If you are a real estate agent / broker

In California, if you are a real estate agent / broker, you are allowed to represent yourself and get the commission (3%) of your house purchase.

If you buy a house that costs $500K, then you will get $15K.

If you buy a house that costs $250K, then you will get $7.5K

Of course, you would need to study and pass the licensing exam and pay a fee. But, the fee is nominal compared to the commission you’d get from a single purchase. In addition, the license is good for 4 years and can easily be renewed.

If you are NOT a real estate agent / broker

Just as you are not required to use a real estate agent to sell your own house, i.e. For Sale By Owner (FSBO), you are not required to use an agent to buy a house for yourself. As such, you can use this fact to present a stronger (more lucrative) offer for the seller of the house you want to buy. You can attach a cover sheet to your offer with a note as follows:

Note to Seller:

This offer is from a buyer with no agent. I (the buyer) am representing myself. As such, acceptance of this offer by you (the seller) would save you from having to pay commission to a buyer’s agent. Since my offer is for $390K, assuming a commission rate of 3%, my offer would save you $390K x 3% = $11,700 and your total commission expense would only be $11,700 to your own agent (seller’s agent). Your net profit (excluding other expenses) would be $390K – $11700 = $378300 as shown below.

| My Offer | Commission to Seller’s Agent | Commission to Buyer’s Agent | Seller’s Net Profit |

| Purchase Price | 3% | 0% | (excluding other expenses) |

| $390,000 | $11,700 | 0 | $378,300 |

If there is another offer above $390K but below $403K and that offer includes a buyer’s agent, then you’d have to pay 6% commission (3% for each agent). In this case, my offer will net you a higher profit as you can see from the table below.

| Other Offers | Commission to Seller’s Agent | Commission to Buyer’s Agent | Seller’s Net Profit |

| Purchase Price | 3% | 3% | (excluding other expenses) |

| $391,000 | $11,730 | $11,730 | $367,540 |

| $392,000 | $11,760 | $11,760 | $368,480 |

| $393,000 | $11,790 | $11,790 | $369,420 |

| $394,000 | $11,820 | $11,820 | $370,360 |

| $395,000 | $11,850 | $11,850 | $371,300 |

| $396,000 | $11,880 | $11,880 | $372,240 |

| $397,000 | $11,910 | $11,910 | $373,180 |

| $398,000 | $11,940 | $11,940 | $374,120 |

| $399,000 | $11,970 | $11,970 | $375,060 |

| $400,000 | $12,000 | $12,000 | $376,000 |

| $401,000 | $12,030 | $12,030 | $376,940 |

| $402,000 | $12,060 | $12,060 | $377,880 |

| $403,000 | $12,090 | $12,090 | $378,820 |

To conclude, my offer of $390K will net you a higher profit than any other offer up to $402K.

Step-by-Step Action Plan

- Find a listing, e.g. on Zillow

- Contact the listing agent and ask them to be your agent as well

- Ask if there is a deadline to submit an offer

- Tour the property, if possible

- Get pre-approved for the maximum you can afford

If your agent is the seller’s agent:

- Wait until the deadline to submit the offer. Since your agent is the seller’s agent, this is not a problem.

- After all other offers come in, place an offer for a little more than the highest bid. Since your agent is the seller’s agent, they’d know what the highest bid is.

- Your agent will then give the seller all offers and you and your agent would know that your offer is the highest which would most likely result in your being chosen by the seller.

If your agent is not the seller’s agent:

- Add an escalation clause to your offer making it clear to the seller’s agent that your offer includes an escalation clause.

- After getting into contract, all other buyers would be blocked from interfering. Once you get the appraisal, if it comes in lower, use it to negotiate a lower purchase price. At that point, it would be unreasonable and a waste of time for the seller to refuse to negotiate and want to start all over since no one wants to pay much more than the appraised value.

- Close the deal