It is January 2, 2021 and the previous year has surprised everyone. Analysts predicted home prices to fall due to the global Coronavirus pandemic but in the US, home prices surged despite millions of Americans losing their jobs.

House Price Index for California

The surge is likely due to

- Very low inventory of houses for sale

- Super low interest rates for 30 year fixed rate mortgage

If we look at historical interest rates, we find that they are historically low.

30-Year Fixed Rate Mortgage Average in the United States

At this time, the cost to rent an apartment in Hayward, California is

- ~$1600 / month for a 1 bedroom apartment

- ~$1800 / month for a 2 bedroom apartment

Now, let’s see how much it costs to buy a house with the following assumptions:

- Buyer credit score is 680

- Buyer has never purchased a home before

The top half of the table below shows 4 different loan scenarios.

- Conventional loan requiring a 20% down payment and a purchase price of $300K

- FHA (first time home buyer) loan requiring a 3.5% down payment and mortgage insurance for a purchase price of $200K, $250K, and $300K

At this time, Zillow indicates that one with a credit score between 680 and 699 can get a 30 fixed rate mortgage for 3%.

For a conventional loan of house costing $300K, if one has $60K for the 20% down payment, their monthly mortgage including principal, interest, taxes, and insurance (PITI) would be $1287. This is far below the the cost to rent a 1 bedroom apartment in Hayward, CA.

For the FHA loan, one would only need a 3.5% down payment but they’d have to pay mortgage insurance. The total monthly mortgage-related expenses (PITI) are

- $1155 for a $200K purchase price

- $1405 for a $250K purchase price

- $1732 for a $300K purchase price

These costs are all lower or equal to the cost to rent in Hayward, CA. The problem, however, is house prices in Hayward are very high. The closest large city with house prices between $200 and $300K is in Stockton, CA, e.g.

Now, just because the monthly mortgage expenses are lower than the cost to rent, that doesn’t mean one would qualify for a loan. Lenders require

- mortgage expenses (PITI) to be no more than 28% of one’s gross monthly income before taxes

- total debt (including mortgage expenses) to be no more than 43% of one’s gross monthly income before taxes

The bottom half of the table below shows different income scenarios as follows:

- Having a gross annual income of $46K and buying a single family home

- Having a gross annual income of $46K, buying a duplex and renting one unit out for $1200 per month

- Having a gross annual income of $60K and buying a single family home

- Having a gross annual income of $60K, buying a duplex and renting one unit out for $1200 per month

- Having a gross annual income of $75K and buying a single family home

In these scenarios, we find that:

If you have a gross annual income of $46K and

- you buy a single family home, then your maximum mortgage expenses can be $1073.33. In this case, you can buy a house for $200K (yellow cells)

- you buy a duplex and rent out one unit for $1200 per month, then your maximum mortgage expenses can be $1409.33. In this case, you can buy a duplex for $250K (green cells)

If you have a gross annual income of $60K and

- you buy a single family home, then your maximum mortgage expenses can be $1400. In this case, you can buy a house for $250K (green cells)

- you buy a duplex and rent out one unit for $1200 per month, then your maximum mortgage expenses can be $1736. In this case, you can buy a duplex for $300K (blue cells)

If you have a gross annual income of $75K and

- you buy a single family home, then your maximum mortgage expenses can be $1750. In this case, you can buy a house for $300K (blue cells)

But Stockton is too far from Hayward!

Assuming you currently live and work in or around Hayward, then it’s true that Stockton is a bit far. According to Google Maps, it’s about a 1 hour drive in no traffic between the two. However, according to this article, many people who work in the Bay Area can no longer afford local housing and have moved to Stockton and commute.

What if I save money and buy a house later?

If you make $46K a year and rent an apartment for $1800 per month, you probably won’t have much left over to save. And, even if you could save $100 per month, house value appreciation could outpace your savings. When you buy a house, some of your monthly payments go towards paying down the principal on your home loan. That, in effect, is a form of savings (pink cells in table) but in the form of equity in the house rather than cash in the bank. After a few years, your wealth could grow in 2 ways:

- Appreciation of house value

- Equity in paying down the principal on your home loan

You could then potentially sell the house and use the proceeds to put 20% down on another house thereby reducing your monthly mortgage payments even further.

What if the house value drops?

According to this article, recessions typically occur around every 10 years but they don’t necessarily cause house prices to flatten or drop. Housing busts typically occur every 18 years. The last housing crisis was in 2008 so the next one may occur in 2026 (5 years from now).

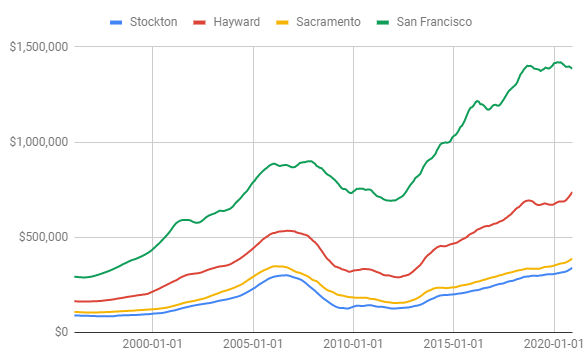

House Value Trends

Using data from Zillow Research Data, we can create a custom graph showing house value trends like the one below.

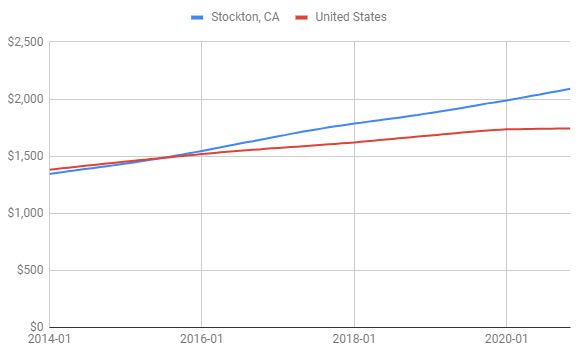

Similarly, we can chart the rent cost over time. Below is an example using US and Stockton, CA rents.