Assuming you have 3 bedroom, 2 bathroom 1100 square foot investment property, following is a breakdown of costs to remodel it relatively cheaply and quickly using neutral colors.

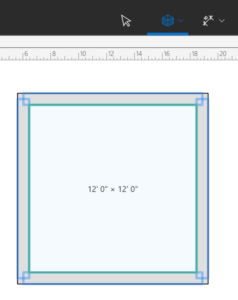

Floor Plan

Using Live Home 3D, this is an example of a 3 bed, 2 bath, 2 car garage house. The kitchen is U-shaped. The bedrooms are almost all the same size. Two of the three bedrooms have walk-in closets. The laundry is central to the house. There is a small patio next to the kitchen and living room.

Colors

Here are the neutral colors we’ll be choosing.

- Floor – beige or light gray

- Wall – beige (Roman Plaster PPU7-10U) Behr / Home Depot

- Ceiling – same as wall color for simplicity or Swiss Coffee

- Baseboard – pure white

- Kitchen cabinets – light gray

- Kitchen appliances – stainless steel

- Kitchen countertop – white

- Bathroom vanity – light gray

- Bathroom sink – white

- Doors – pure white

Wall

Replace all outlets and switches with Dekora ones

(Roman Plaster PPU7-10U)

Behr / Home Depot

Ceiling

Spray walls and ceiling same color for simplicity. Or, spray ceiling Swiss Coffee.

Floor

Choose large 12”x24” tiles for fewer grout lines and quicker completion.

Kitchen

- Get cabinets from IKEA. They deliver.

- Average 10×10 kitchen

IKEA 10×10 kitchen

~ $3500

Light gray cabinets with off white countertop

Go with a solid color so in case it gets damaged, it can easily be painted gray.

Bathroom

$230

Go with a solid color so in case it gets damaged, it can easily be painted gray.

Buy at Marshalls, Ross, TJ Maxx for less

Laundry

Landscaping

3/4″ Ginger rock

By at a rockery and have delivered

Italian Cypress Trees

$40 / tree at Costco (only available in Spring)

$100 / tree at a nursery

Garage Floor and Driveway

Whole House Renovation Plan

- Turn on water, gas and electricity

- Use laser measure to measure each room

- Use Live Home 3D to draw floor plan

- Print multiple copies of floor plan and staple to wall

- Demolition – Day 1 – 2

- Wear coveralls / protective clothing

- Lay down large tarp in driveway to make debris cleanup easier

- Demolish kitchen using Bosch jackhammer, monster sawzall and pry bar

- Remove both bathroom toilets and and vanities

- Remove all flooring.

- Rent floor surface prep tool to smoothen floor. Include the garage floor.

- Remove all outlets and switch covers

- Remove all interior door knobs, if necessary

- Put all debris in driveway

- Vacuum all dust using cyclone filter to minimize filter clogs and simplify disposal

- Drywall – Day 3

- Add drywall where necessary

- Patch holes in walls where necessary

- Texture walls where necessary

- Paint – Day 4

- If reusing baseboard, label each baseboard with a number and label corresponding wall in the floorplan with the same number

- Remove baseboard and put on floor and cover with plastic

- For each area that needs to be covered, e.g. outlets, ceiling lights, registers, vents, etc, cut painter’s plastic to size

- Spray glue around the area that needs to be cover and stick plastic to it

- Wear coveralls / protective clothing

- Use air sprayer to spray paint on walls and ceilings.

- If necessary, spray paint doors white

- Floor and Wall Fixtures – Day 5 – Day 9

- Pay someone to install tile flooring on all floors

- While floor tiles are being installed, do following

- Replace outlets, switches and plates with Dekora ones

- Install bathroom lights

- Install bathroom towel hangers

- Replace all door knobs, if necessary

- Paint baseboard

- Kitchen – Day 10 – Day 13

- Pay someone to install IKEA kitchen

- Install kitchen appliances

- Pay someone to install quartz countertop

- Bathrooms – Day 13

- Install toilets

- Install vanity

- Install vanity faucet

- Landscaping – Day 14 – 18

- Remove trees

- Rent mini skid steer to remove 3 inches of dirt

- Rent excavator to dig holes for Cypress trees

- Plants Cypress trees

- Lay down weed fabric

- Lay down cement board

- Pour and level Ginger rocks

- Debris removal – Day 19

- Rent dumpster

- Transfer all debris from driveway to dumpster for haulaway

- Fence, garage floor, driveway, and exterior cement walkways – Day 20 – Day 21

- Pressure wash the garage floor, driveway and fence

- Spray tan Granite Grip using air compressor

- Paint fence

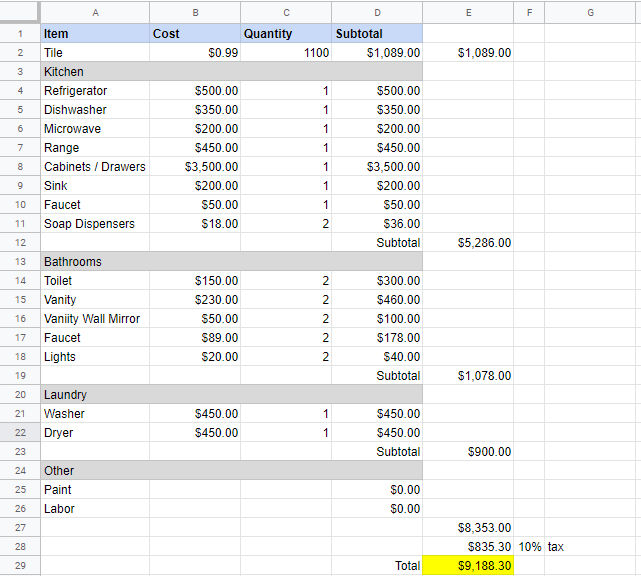

Cost Breakdown

Using a spreadsheet, create a cost breakdown like below.

Based on this, we can estimate that including labor and other items, the total cost for a whole house renovation would be around $20K.