When an economic recession occurs, one thing that happens for sure is the unemployment rate goes up. You can see a graph of the California unemployment rate since 1967 on the St. Louis Federal Reserve Bank’s website. Below is a copy of that graph until 2019-01-01.

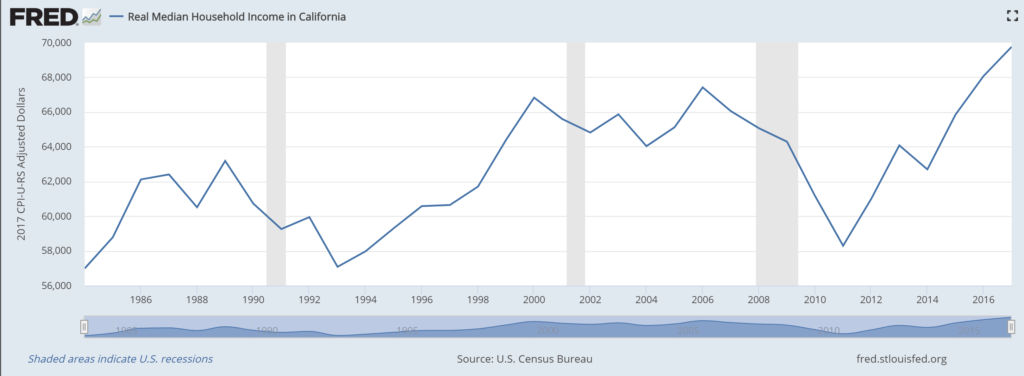

The shaded areas indicate a recession. As you can see, the unemployment rate has jumped up during each recession. Logically, as unemployment goes up, incomes go down since fewer people are working. Following is the graph of real median household income in California over the years.

So how do you know when a recession will occur. It turns out that the best indicator of a recession is when the Treasury Yield Curve inverts.

Continue reading Recessions, Home Prices, Unemployment and Inflation