tl;dr

- Increase your credit score as quickly and as high as possible (minimum 680)

- Eliminate as much debt (credit cards, loans) as possible, e.g. monthly payments for a fancy car, etc.

- Save as much money as possible (minimum $20,000)

- Buy a used duplex (2-unit property) preferably with existing tenants where at least one tenant is paying the market rate for rent

- Kick out the lower paying tenant and live in that unit

- Slowly fix up the property as money becomes available and time permits to increase its value

- After a few years, the home’s value will have appreciated and you will have more equity in the house. You can remain in that living situation or you can sell the duplex, take the profit, buy a single family residence or a better duplex or triplex.

Introductory Facts

Homeownership is the number one way for people to move from the lower class to the middle class and to build wealth.

People who own homes are almost always better off financially than people who always rent.

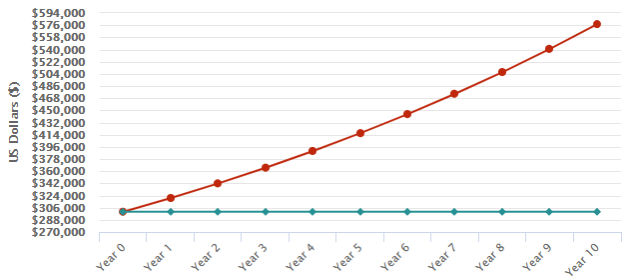

Real estate (e.g. houses) always increases in value over the long term (see graph below). The only exception was between 2008 – 2012 which was due to mortgage fraud and greedy banks which led to a global recession. It is now illegal to commit mortgage fraud which should prevent significant depreciation from occuring again.

Source: https://fred.stlouisfed.org/series/CASTHPI

The average rate of appreciation of real estate in California is about 6.77% annually. That means if you buy a house for $300,000, then in one year, the value will have gone up by $300,000 x 6.77% = $20,310. You will have made $20,310 in one year for doing nothing but living in your own home. In 10 years, due to compounding appreciation, your home’s value will have increased by $277,582.

On the other hand, cars always lose value as time goes on. As a matter of fact, they lose an average of 15% per year.

Source: https://en.wikipedia.org/wiki/Depreciation

Jeff Bezos, CEO of Amazon and richest person in the world, drove a Honda Accord in the 1990s even though he was a billionaire at the time.

Source: https://www.carwow.co.uk/blog/top-10-billionaires-cars#gref

When you rent, your entire monthly rent payment is spent and you get none of it back. However, when you buy a house and pay a mortgage, you get some of your mortgage payment back in the form of equity in the home. For example, if you borrow money from a bank for $300,000 at 3% interest fixed for 30 years (360 months) with a 3.5% down payment ($10,500), your monthly payments during the beginning and ending years will look like this:

| Month | Principal & Interest | Principal | Interest | Principal Remaining |

|---|---|---|---|---|

| 1 | $1,221 | $497 | $724 | $289,003 |

| 2 | $1,221 | $498 | $723 | $288,505 |

| 3 | $1,221 | $499 | $721 | $288,006 |

| …. | ||||

| 358 | $1,211 | $1,211 | $9 | $2,434 |

| 359 | $1,211 | $1,214 | $6 | $1,220 |

| 360 | $1,211 | $1,220 | $3 | $0 (loan paid off) |

As you can see in the table above, in the beginning years, even though you pay $1221 per month for your mortgage, you are getting almost $500 back in the form of equity which is like a savings account but in the form of home value instead of at a bank. Your interest payments in the beginning are around $720 but it’s not money completely lost because mortgage interest is tax deductible which can lower your tax bill.

Rent always increases whereas mortgage payments never increase (on a fixed loan). As a matter of fact, nationally rent prices have increased an average of 8.86% per year since 1980, consistently outpacing wage inflation by a significant margin.

Source: https://ipropertymanagement.com/research/average-rent-by-year

Between 2008 and 2020, annual wage increases for hourly employees maxed out at just above 3.5% which is less than both

- the annual rate of rent increase (8.86%) since 1980

- the annual rate of California home value appreciation (6.77%)

This means that your income growth is less than your housing expense growth. This also means that if you live month to month, as time goes on you will have less and less money as rent increases faster than your income.

Property Types

There are different types of properties, e.g.

- Manufactured / mobile home

- Condo

- Townhouse

- Single Family Residence

- Multifamily Residence (duplex – 2 units, triplex – 3 units, 4-plex – 4 units)

- Commercial (5 units or more)

Manufactured / mobile home

Never buy a manufactured / mobile home. Though they are cheap, you will have to rent the land and if the landowner increases the rent on the land, you will most likely have no choice but to pay the increase since it would be difficult and very expensive to move your mobile home somewhere else. Even if you own land and buy a manufactured home to put on it, you will not be able to get a low-interest home loan to purchase a mobile home.

Condos and Townhouses

Condos and townhouses are cheaper than single family residences but you will have to pay an HOA (homeowner’s association) fee which can be very expensive, especially if there is a swimming pool. Also, you are limited in what you can do to your own home, e.g. you can’t paint the exterior, you can’t move walls, build additions, etc. You are better off not buying a condo or townhouse.

Single Family Residence

This type of home is ideal for a single family. However, unless your financial situation is good, it would be difficult to afford one.

Multifamily Residence

(duplex – 2 units, triplex – 3 units, 4-plex – 4 units)

This type of property is usually purchased by investors. However, anyone can buy one and live in one of the units and rent out the other units. Of course, the more units, the more expensive. Therefore, for first time homebuyers with a limited income, it is recommended to buy a duplex. The strategy recommended in this article is to live in one unit and rent out the other unit and let the rental income pay for some, most, or all of your mortgage.

Commercial (5 units or more)

This type of property is usually purchased by big investors or companies who have a lot of money. Most people cannot afford this type of property.

Number of Bedrooms and Bathrooms

Most houses come with either

- 2 bedrooms and 1 bathroom, a.k.a. 2/1

- 3 bedrooms and 2 bathrooms, a.k.a. 3/2

To keep costs low, focus on duplexes where each unit has 2 bedrooms and 1 bathroom.

Potential Rental Income

Since the recommended strategy is to buy a duplex and live in one unit and rent out the other, you need to know the potential rental income you will get to offset your mortgage expenses. To determine this, you can go to Rent-o-meter.

For example, the 2/1 duplex at 8420 Don Ave, Stockton, CA 95209 has an average rental income of $1493 for each unit. Therefore, if you buy this duplex, you could potentially get $1493 per month from your renter to help pay for some or all of your mortgage.

Determine Costs

As a first-time home buyer, you are entitled to the FHA First-Time Home Buyer program. This program allows you to borrow money to buy a house and only put a down payment of 3.5% as opposed to 20% for non-first-time home buyers and 25% for investors. However, if your down payment is less than 20%, you will have to pay private mortgage insurance (PMI).

When you buy a house with a 3.5% down payment, you will borrow money and pay interest. You will also have to pay for

- Private mortgage insurance

- Fire insurance

- Property tax

To determine these expenses, go to Zillow > Home Loans > Mortgage Calculator.

https://www.zillow.com/mortgage-calculator

For example, for a loan with the following numbers:

| Purchase Price: | $300,000 |

| Down Payment: | 3.5% (10,500) |

| Loan Type: | 30-year fixed (always choose this type) |

| Interest Rate: | 3% |

your total monthly mortgage-related expenses would be $1734.

However, since your rental income will be on average $1493, then your net monthly mortgage-related expenses will be

$1734 – $1493 = $241 per month

In other words, your monthly housing costs become ONLY $241 per month! But, that depends on

- whether you can find a 2/1 duplex for $300,000

- whether your credit score is good enough that you can get a loan with a 3% interest rate

- whether you can actually rent out the other unit for $1493 per month

Interest Rates

Interest rates on your loan make a very big difference in your monthly mortgage expense and your lifetime loan cost. Due to the Covid-19 pandemic, the federal government lowered interest rates to almost zero to stimulate the economy and avoid a recession. In doing so, interest rates on home loans have been very low. As a matter of fact, interest rates have never been lower than now as indicated in the graph below.

Source: https://fred.stlouisfed.org/series/MORTGAGE30US

Therefore, now is THE BEST TIME to get a home loan because the interest rates are at the LOWEST they have ever been. If you wait 2, 4 or 6 years from now, interest rates may go back up to 4 or 5% which means your monthly mortgage payments will be much higher.

Credit Score

Your credit score has a VERY BIG impact on the interest rate of your home loan. The higher your credit score, the lower the interest rate, and the cheaper your monthly mortgage expenses. Therefore, you want your credit score to be as high as possible.

To determine the interest rate you can get for different credit scores, you can go to Zillow > Home Loans > Mortgage Rates

https://www.zillow.com/mortgage-rates/

For example, for a loan with the following numbers:

| Purchase Price: | $300,000 |

| Down Payment: | 3.5% (10,500) |

you will find the following interest rates for different credit scores.

| Credit Score | Interest Rate |

|---|---|

| 560 – 599 | No loans available |

| 600 – 619 | No loans available |

| 620 – 639 | No loans available |

| 640 – 659 | 3.5% |

| 660 – 679 | 3.25% |

| 680 – 699 | 2.75% |

| 700 – 719 | 2.75% |

| 720 – 739 | 2.75% |

| 740 – 759 | 2.75% |

| 760 and above | 2.75% |

The rates above were valid on July 4, 2021. Interest rates change daily and throughout the day.

As you can see above, if your credit score is below 620, you can’t even get a loan. Also, the higher your credit score, the lower the interest rate.

In order to improve your credit score, sign up for a free Credit Karma (https://www.creditkarma.com/) account, enter your information, and under “Credit Scores”, you will see your score for Transunion and Equifax followed by ways to improve each score.

Notice that there are 6 factors that affect your credit score, 3 of which are high impact.

| Factor | Impact | Description |

|---|---|---|

| Payment History | High | Percent of payments you’ve made on time |

| Credit Card Use | High | How much credit you’re using compared to your total limits |

| Derogatory Marks | High | Collections, tax liens, bankruptcies or civil judgments on your report |

| Credit Age | Medium | Average age of your open account |

| Total Accounts | Low | Total open and closed accounts |

| Hard Inquiries | Low | Number of times you’ve applied for credit |

From here on, we will assume you have increased your credit score to 680 and since interest rates change all the time, we’ll assume you can get a rate of 3%.

Interest Rate VS Loan Cost

Interest rates affect the cost of a loan and your monthly payments. Following are monthly mortgage costs and total loan costs for a $300,000 home loan at 30-year fixed at various interest rates.

| Interest Rate | Monthly Mortgage Payment | Total Loan Cost Over 30 Years |

|---|---|---|

| 2.5% | $1,190 | $123,000 |

| 3% | $1,227 | $151,000 |

| 3.5% | $1,307 | $180,000 |

| 4% | $1,389 | $209,000 |

| 4.5% | $1,474 | $240,000 |

| 5% | $1,562 | $271,000 |

| 5.5% | $1,652 | $304,000 |

| 6% | $1,745 | $337,000 |

As you can see, the interest rate makes a big difference in your monthly payment and loan costs. For example, for a 5% interest loan, you’ll be paying an extra $335 per month and an extra $120,000 over 30 years compared to a 3% interest loan for $300,000.

Mortgage-to-Income Ratio

Lenders require that in order to give you a home loan, your mortgage expenses (PITI) must not be more than 28% of your gross monthly income before taxes. PITI stands for

- P = Principal

- I = Interest

- T = Taxes

- I = Insurance

Let’s say that your total monthly income is $3000 per month before taxes. That means your PITI may be no more than 28% x $3000 = $840 per month. However, if you buy a duplex, then your total monthly income will increase by the rental income of, say, $1400 per month, which would bring your total monthly income to $4400. Therefore, your PITI for a duplex can be no more than $4400 x 28% = $1232 per month.

Debt-to-Income Ratio

Lenders also require that your total debt (including mortgage expenses) be no more than 43% of your gross monthly income before taxes. For example, if your monthly income is $3000 per month and your fancy car’s monthly payments are $350 per month and you are looking at buying a house with an estimated PITI expenses of $1000 per month, then your debt-to-income ratio is

Debt-to-Income Ratio = Debt / Income = ($350 + $1000) / $3000 = 0.45 or 45%

Since 45% is greater than 43%, you would not qualify for a loan.

Calculations

To help see all important numbers in one place, you can create a spreadsheet similar to the one below.

| Loan Type | FHA – First-Time Home Buyer |

| Purchase Price | $300,000 |

| Minimum Credit Score | 680 |

| Down Payment (%) | 3.5% |

| Down Payment ($) | $10,500 |

| Interest Rate | 3% |

| Term | 30 years fixed |

| Mortgage – Principal | $497 |

| Mortgage – Interest | $724 |

| Mortgage – Insurance (PMI) | $236 |

| Property Tax | $170 |

| Insurance | $105 |

| Total Monthly Cost (PITI) | $1,732 |

| Property Type | Duplex |

| Income – Work (Annual) | $60,000 |

| Income – Work (Monthly) | $5,000 |

| Income – Rental (Monthly) | $1,300 |

| Total Gross Monthly Income | $6,300 |

| Max Monthly Mortgage to Income (%) | 28% |

| Max Monthly Mortgage Allowed ($) | $1,764 |

| Max Monthly Total Debt to Income (%) | 43% |

| Max Monthly Total Debt Allowed ($) | $2,709 |

Finding a House for Sale

As mentioned above, the strategy is to buy a “used duplex”. To find these, go to Zillow and do a search.

The search criteria can be

- Stockton, CA

- For Sale

- By Agent

- Home Type

- Multifamily

You can save this search as “Stockton Duplex” so you get notified whenever a new listing goes on the market.

Sort the search results by price from cheapest to most expensive. We’ll use the following listing as an example:

$449,000 2 bd– ba 2,340 sqft

3012 Amherst Dr, Stockton, CA 95209

For sale Zestimate®: $423,300

https://www.zillow.com/homedetails/3012-Amherst-Dr-Stockton-CA-95209/15288727_zpid

The color is ugly but maybe that’s why no one has bought it. You can always paint it.

Rental Income:

This duplex may already have renters in both units. If you buy it, you can kick out the renter who is paying the lower amount and then live in that unit yourself.

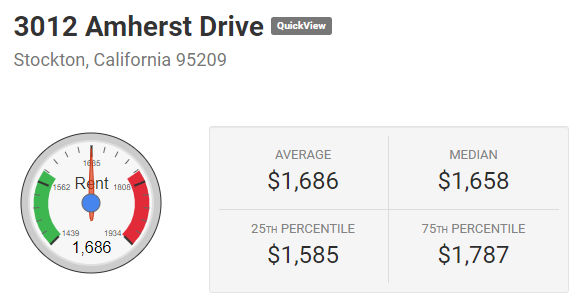

If the duplex isn’t rented, you can check Rent-o-meter to determine average rent. After entering the address in www.rentometer.com, we see that the average rent is $1686.

Mortgage Expenses:

Now, we need to calculate our mortgage expenses by going to Zillow’s mortgage calculator. For a loan with the following numbers:

| Purchase Price: | $449,000 |

| Down Payment: | 3.5% ($15,715) |

| Loan Type: | 30-year fixed (always choose this type) |

| Interest Rate: | 3% |

we get the following

This means that your total monthly housing expense will be $2596.

You net monthly housing expense becomes

$2596 – $1686 = $910 per month

$910 / month is very cheap for 2 bed 1 bath housing in Stockton and is much cheaper than renting. Also, as time goes on, the value of the property will go up on average 6.77% per year.

To reiterate, for the example above,

| your net monthly housing expense would be | $910 per month |

| you need a down payment of | $15,715 |

| you need a credit score of at least | 680 |

| you will need to pay for loan closing costs in the average amount of | $5000 |

Get Pre-Approved

Before making a move to buy a house, you increase your chances of success by first getting pre-approved. Don’t simply get pre-qualified because that doesn’t carry as much weight as a pre-approval. A pre-approval will verify your financial situation so you can feel confident you will be able to afford a house at a particular price. When the time comes, you can and should include your pre-approval letter with your house purchase offer so the sellers know you are serious and can afford to buy their house. When getting pre-approved, mention that you are interested in buying a duplex and renting out one of the two units so that the rental income is accounted for.

You can get pre-approved by Zillow Home Loans.

https://www.zillow.com/pre-approval/#/pre-approval

Find a Real Estate Agent

Since you are new to buying a house, you’ll want a real estate agent to guide and help you. You can easily find a real estate agent by searching Google for “Stockton real estate agent”.

Once you agree to work with an agent, you can tell them the type of property you want to buy (used duplex) and give them your pre-approval letter. You can then tell them which active listings on Zillow (or Redfin – www.redfin.com) you are interested in. The agent may also have pocket listings / off-market listings that meet your criteria.

Make an Offer

Once you decide to put an offer on a house, you need to decide how much you are willing to pay for it. In a hot market, there could be competition driving up prices. If Zillow estimates the house to be worth $360,000 and the seller is asking for $360,000, then you may want to offer $370,000 to beat the competition. Note, however, that in a hot market, values can go up quickly. I offered $30,000 above the asking price and I still got outbid by someone who bought the property for $40,000 above asking.

Your agent can help you determine the value of the house and draft up a purchase offer. You will review the offer letter for accuracy and then sign it. Your agent will then submit the offer to the seller’s agent and wait for a response. If the seller accepts your offer, then you’re locked in and the seller cannot change their mind and sell to someone else.

NOTE:

- For tips on buying a house, read my article titled House-Buying Tips.

- For strategies on competing with other buyers in a hot market, read my article titled House-Buying Strategies.

Get a Loan and Fire Insurance

Home Loan

I have not purchased a home using the FHA First-Time Home Buyer program. However, I have found LoFi Direct to offer very competitive rates for home loans.

You can also compare lenders and rates on Zillow’s Rate Comparison page.

https://www.zillow.com/mortgage-rates/#/

Fire Insurance

For fire insurance, I recommend using a broker to shop around and find a deal for you. They usually can offer lower rates than if you go directly to the large insurance companies. Just search Google for “home insurance broker”.

Close Escrow

Once everything is in order, you will “close escrow” which means you finalize the deal. It takes about one month from when your offer is accepted to when you close escrow. Once you close escrow, you become the legal owner of the property and you can move in. Just make sure you pay your mortgage payments and property tax so the lender and government don’t take your house from you.